ST: Bullish w/Caution, LT: Moderately Bullish

Short‑Term (1 week), Bullish with caution

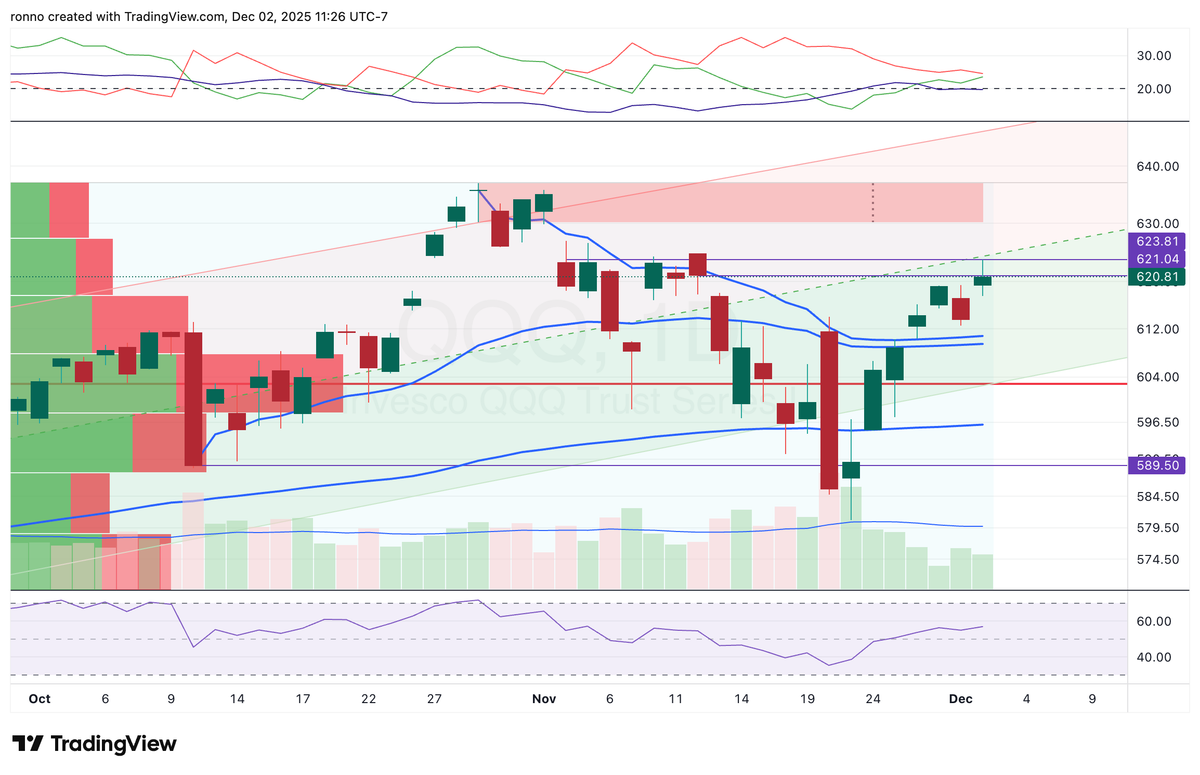

- QQQ has climbed from 585 → 614, breaking the late‑October downtrend and closing above the recent VWAP and point‑of‑control.

- Breadth has turned positive: % of stocks above the 20‑day MA jumped to 71 % (from 61 % at the October peak).

- Sector participation is improving—Consumer Discretionary, Industrials and Financials are posting solid gains, while the broader S&P 500 index is reclaiming last Thursday’s highs.

- VIX sits at 18.56, reflecting a moderate volatility environment that supports a modest rally.

- Rate‑cut probability has risen above 65 %, and the latest jobs report showed resilience, both of which ease near‑term risk sentiment.

Conclusion:* The market’s technical and fundamental backdrop favours continued upside for the coming week, but the recent straight‑up run may encounter consolidation before any decisive breakout.

Long‑Term (1 + month), Moderately bullish

Despite the recent rally, weekly momentum (MACD) remains negative and only three of the 11 S&P sectors posted gains over the past month, highlighting the need for broader strength.

- NVDA, despite an earnings beat, failed to sustain momentum; however, its failure to breach key support suggests limited downside, setting the stage for a short‑covering rally into mid‑December.

- Industrials have recaptured prior lows, indicating a potential “overweight” sector that could lift broader indices.

- Rising expectations of a December rate cut, combined with a seasonally supportive period and a noticeable improvement in market breadth, point to a sustained recovery into year‑end.

- Historical seasonality and lacklustre sentiment imply that after a short consolidation post‑Thanksgiving, markets are positioned to challenge new highs after the FOMC meeting.

Conclusion: The longer‑term outlook leans bullish, with a likely rebound to fresh highs in the December‑January timeframe once the current momentum consolidates.