Growth Strong, Sentiment Soft: QQQ & Macro Snapshot

Short‑term (1 week) – Bullish

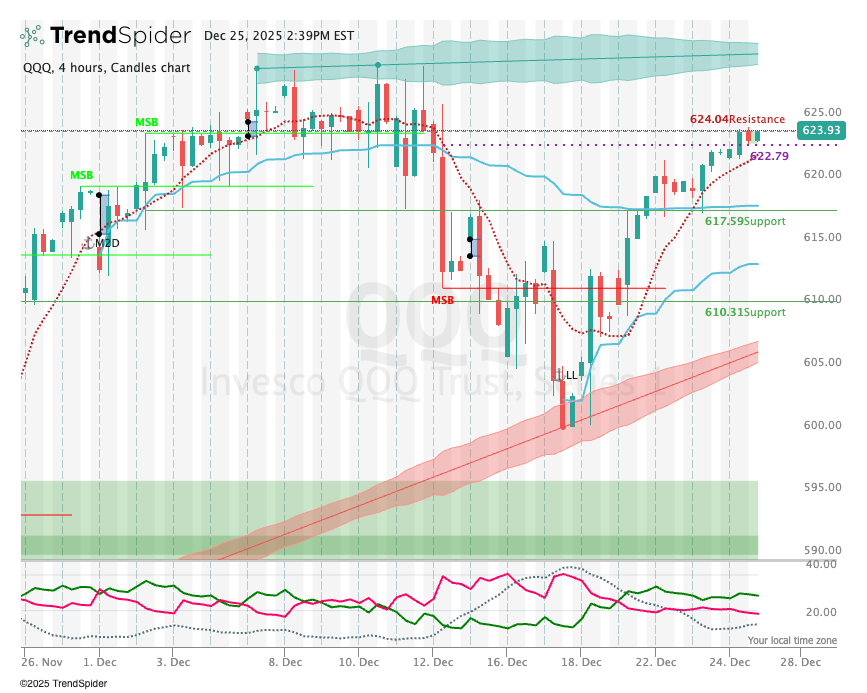

- QQQ rose from 609.1 to 623.9 in four days, pushing above its 20‑ and 50‑day EMAs and approaching the 627/637 resistance zones.

- VIX at 14.00 signals low‑volatility, risk‑on sentiment.

- Fresh GDP print of 4.3 % (annualized) driven by consumption reinforces momentum.

- Initial claims fell to 214k, a three‑year low outside holiday spikes, indicating a steady labor market.

Longer‑term – Moderately Bullish with Caution

- Core retail sales +0.8 % MoM and +4.8 % YoY show solid underlying demand.

- CPI eased to 2.7 % YoY (0.2 % over two months), easing inflationary pressure.

- Wage growth at 3.5 % YoY supports consumption.

- Weak consumer confidence (near five‑year low) and QQQ lagging broad market indices suggest lingering sentiment risk.

- Tech underperformance (QQQ below SPX highs) could cap upside until the sector catches up.