January Summary

A balanced view of the 2026 stock market reveals a tug-of-war between strong historical momentum and emerging technical and policy risks. As of late January 2026, the S&P 500 has hit a historic milestone of 7,000 for the first time. While the near term shows signs of technical improvement, experts suggest the market is not yet "out of the woods".

The Case for Continued Growth

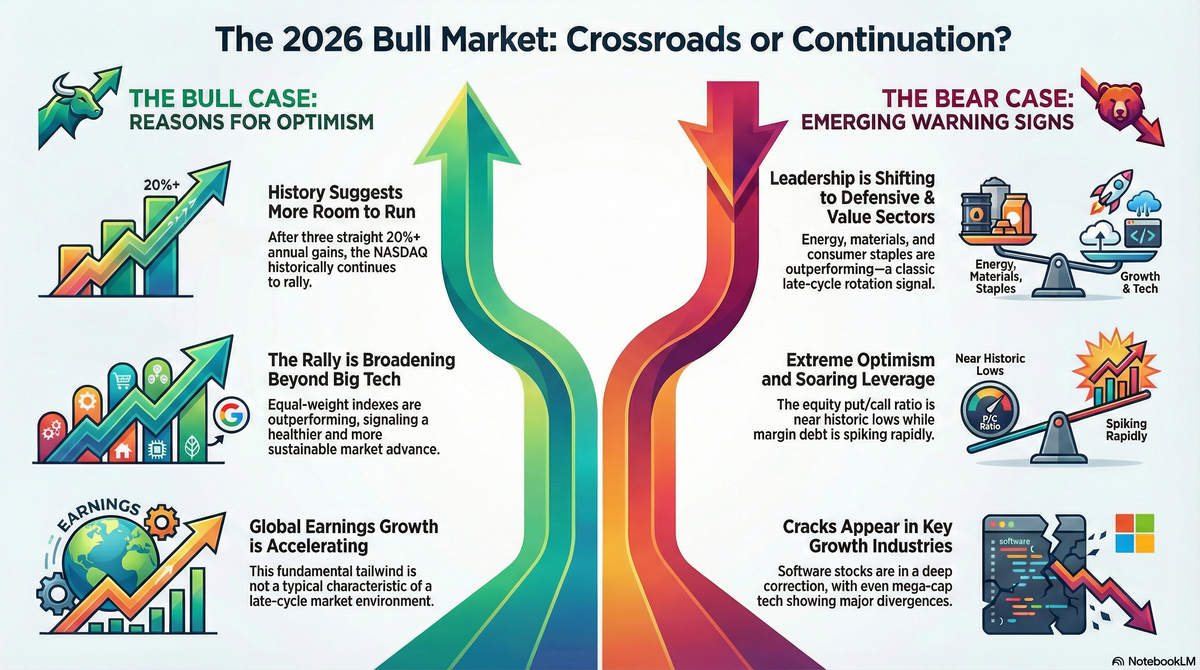

Historical data and current market leadership provide several reasons for optimism:

- Historical "Year 4" Patterns: After three consecutive years of 20%+ gains, the Nasdaq is entering its fourth year of a rally. Since 1970, the index has never stopped a rally at exactly four years; it typically advances for five to six straight years after a major down year. Statistically, there is a 67% probability that the Nasdaq will register a fourth year of gains.

- The "First Five Days" Indicator: The first five trading days of 2026 were positive. Historically, when the first week and first month are positive, the probability of an "up year" for the market jumps to 92%.

- Sector Leadership: Leadership is currently coming from Technology, Energy, and Communication Services. Technology's strength is particularly notable as it accounts for 34% of the S&P 500 and typically pulls the broader index higher.

- Disruptive Innovation: The rally continues to be fueled by Generative AI and Robotics, which are viewed as long-term "force multipliers" for the economy.

Risks and Potential Pullbacks

Despite the record highs, several indicators suggest a period of volatility or a "cleansing" drawdown may be approaching:

- Expected Mid-Year Drawdown: Some strategists project a strong start to the year followed by a drawdown that feels like a bear market (potentially 10-20%) triggered by "policy shocks" rather than economic decline.

- Margin Debt Warning: New York Stock Exchange margin debt reached a record high of $1.2 trillion in late 2025. Historically, once the percentage gain in margin debt exceeds 38% year-over-year, forward returns often turn negative.

- Mixed Earnings Reactions: Early 2026 earnings reports have shown high volatility; while Meta saw gains, Microsoft experienced a significant sell-off (down 12% in a single day), suggesting investors are becoming more discerning and less tolerant of high valuations.

- Consumer Stress: There is evidence of "low-grade" stress in subprime and auto loans, which could eventually weigh on the broader market if economic conditions shift.

Market Shifts to Watch

The internal "plumbing" of the market is changing in ways that may benefit diversified investors:

- Broadening Breadth: The market is beginning to separate "the wheat from the chaff," with leadership moving beyond just the "Magnificent Seven". Institutional investors are finding new opportunities in international large caps and non-US markets that are seeing improved earnings growth.

- Energy and Value Tilt: Energy and basic materials are currently viewed as top sector picks due to significant underperformance over the last several years. A value-tilted approach is also recommended for those concerned about stagflation—a regime of sluggish growth and persistent inflation.

- Crypto Deleveraging: In contrast to the stock market, the crypto market saw a massive deleveraging event in late 2025 that liquidated over 2 million accounts, leaving Bitcoin and Ethereum struggling to find a bottom in early 2026.

The Bottom Line: While the primary trend remains bullish, the near term is characterized by record-high leverage and high valuations. A "balanced" approach for early 2026 may involve participating in the tech and energy momentum while maintaining a "playbook" for potential stagflation or a policy-driven correction.

What About Gold?

To provide a complete picture of the 2026 market, it is essential to include the "metal mania" currently sweeping the precious metals sector. Both gold and silver have become a central part of the 2026 investment narrative, serving as both a speculative "trade" and a strategic defensive hedge.

Here is how gold and silver fit into the balanced view of the 2026 market:

The Case for the "Precious Metals Mania"

In early 2026, precious metals have seen a historic surge in interest and valuation:

- Parabolic Price Action: Strategists describe the current move in silver and gold as "parabolic," with gold reaching its best month since 2008. Some technical analysts suggest that gold could reach as high as $8,900, driven by even small incremental allocations (as little as 0.5%) from high-net-worth investors.

- Record-Breaking Volume: Trading volume in precious metal ETFs has skyrocketed to $64 billion, far surpassing previous peaks of $20 billion. This "metal mania" has made gold (GLD) and silver (SLV) among the most discussed assets on retail trading forums.

- Absorption of Speculative Capital: There is evidence that capital is rotating out of the crypto market and into precious metals. Investors who previously sought "digital gold" in Bitcoin appear to be moving toward physical metals because they are "working better" in the current environment.

The Strategic Role: A "Stagflation Playbook"

Beyond speculation, gold and silver serve a specific structural purpose in a diversified 2026 portfolio:

- Chaos and Currency Hedge: Gold is viewed as a critical hedge against monetary debasement, geopolitical stress, and a loss of confidence in fiat currency.

- Stagflation Protection: Historically, gold is one of the strongest performers during regimes of high inflation and suppressed real yields. In a "Stagflation Playbook," a 10% allocation to gold is recommended to protect real purchasing power without letting a potential bear market in metals dominate the overall portfolio risk.

- Physical Market Tightness: Experts note that the physical market for these metals is currently "tighter" than the financial markets, leading to even higher prices for physical delivery than what is seen on paper exchanges.

Risks to the Metals Rally

Despite the bullish momentum, there are significant warning signs to consider:

- The 1980 Parallel: Some analysts compare the current price action to the 1979–1980 "topping process," suggesting the rally may be reaching an exhausted, parabolic peak.

- Intraday Volatility: While buyers have been "flooding in" to buy every dip, the market has seen massive intraday declines, signaling high volatility.

- Rebalancing Risks: For strategic investors, if a "spike" causes gold to exceed its target allocation, it may be necessary to trim the position back to 10% and recycle those gains into laggards like value equities.

The Bottom Line: Gold and silver are currently acting as a "refuge" for capital in an "everything but the dollar" rally. While they offer vital protection against stagflation and policy shocks, their recent parabolic rise suggests that investors should approach them with a mix of strategic holding and tactical caution.