Market Rally Stalls as Volatility Rises

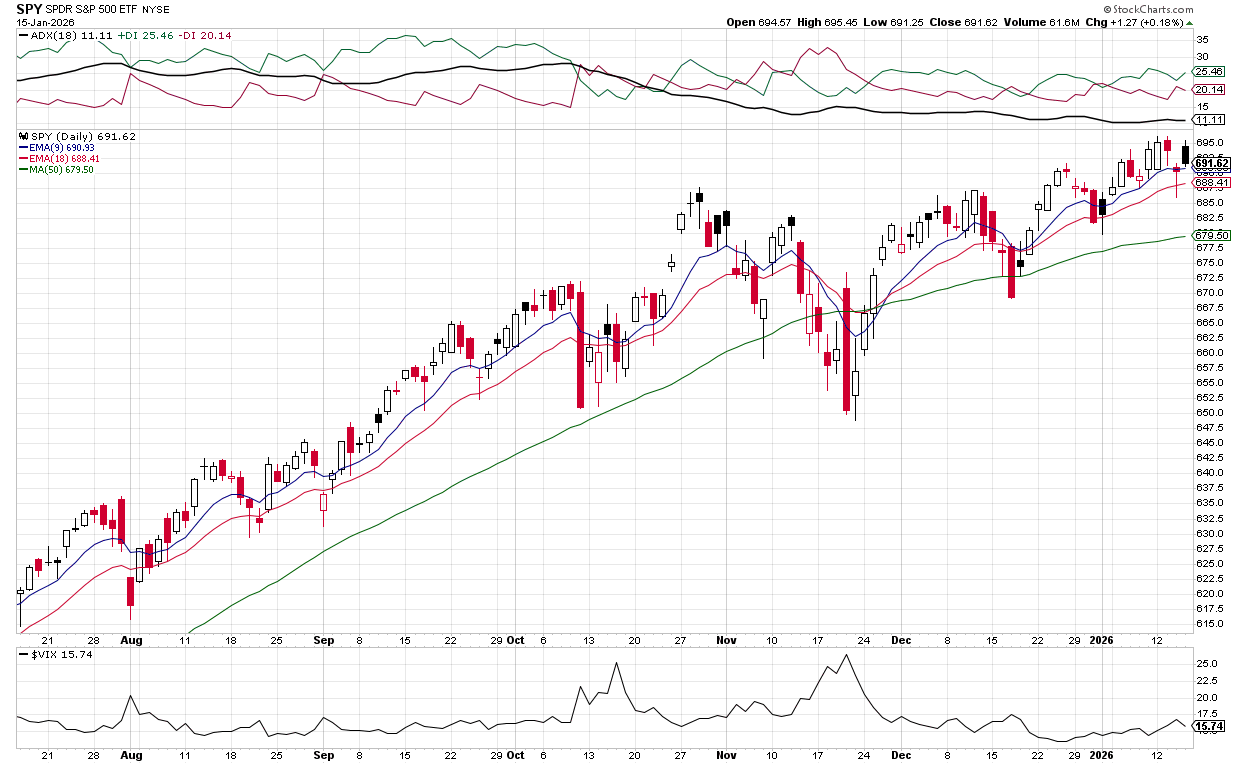

The major indices are showing signs of fatigue after last week's record-breaking rally. QQQ closed Tuesday at 619.55, trading below its short-term EMAs (5-day at 622.44), while SPY settled at 690.36, also underperforming its 5-day EMA of 691.74.

VIX has climbed to 16.75 from 15.12 earlier this week, signaling increased volatility expectations. The technical picture shows both QQQ and SPY testing their 20-day EMAs as support, with QQQ's 20-day at 620.87 and SPY's at 688.85.

The market is experiencing the typical January consolidation pattern, with technology laggards weighing on broader indices. Despite the S&P 500's record highs last week, current price action suggests a pause in the momentum as the market digests mixed economic data and prepares for Fed meetings.