Near-Term Upside, Longer-Term Caution

Short term (1 week): Bullish

- S&P 500 set a new record; breadth and tech leadership improving.

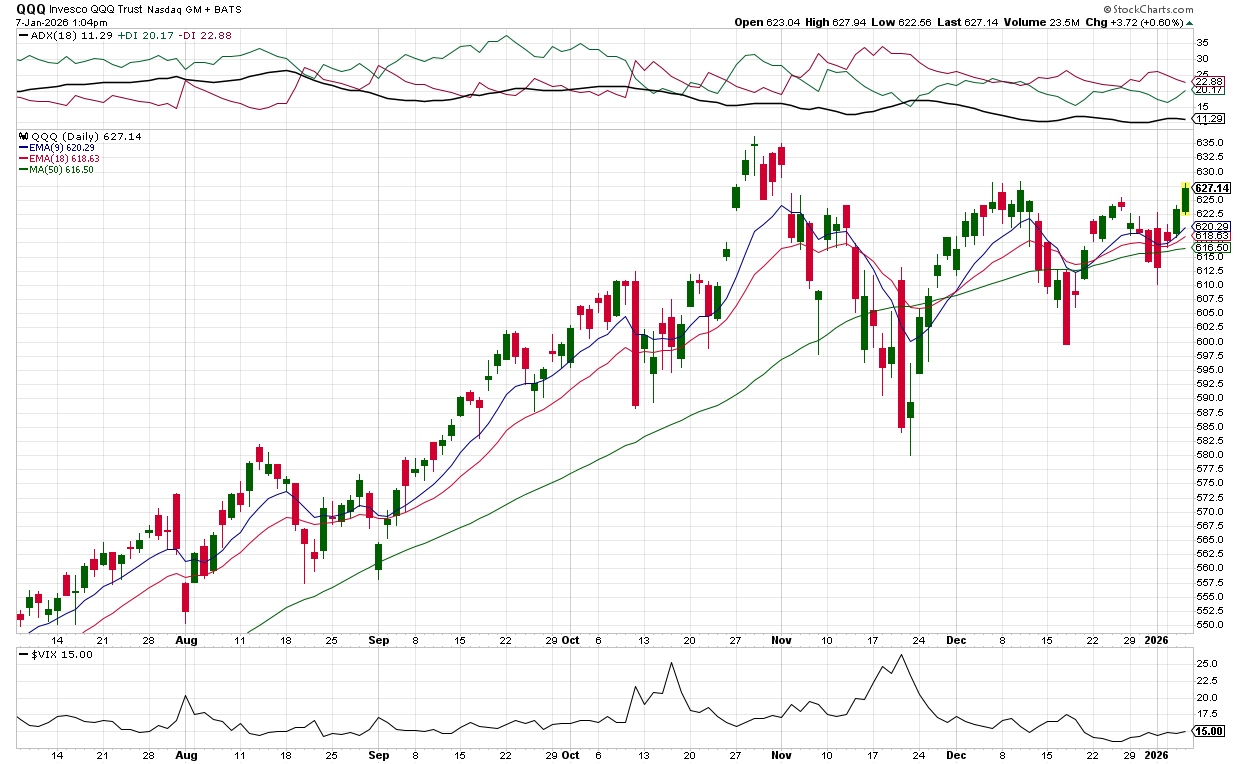

- QQQ approaching breakout (needs 625.52; above 629 for confirmation), with price above key EMAs.

- Low VIX (~14.9) supports risk-on flow; SPY cleared minor downtrend.

- ISM services beat; Fed easing stance still supportive; pending home sales strong.

Long term (1+ months): Bearish bias

- Three-year S&P run near 90% with only five precedents; history shows drawdowns afterward (1956 bear, 1987 crash, late-90s secular bear, 2022).

- Wall Street consensus near-universal bullish—tactical contrarian risk.

- Underlying breadth mixed (ISM services headline strong but industry growth narrow; labor resilience contrasts with soft spots).

- Tech (QQQ) still coiling near resistance; sustained breakout needed to offset secular caution.