QQQ Breaks October Downtrend: Constructive Near-Term Consolidation, Bullish Bias Into Year-End

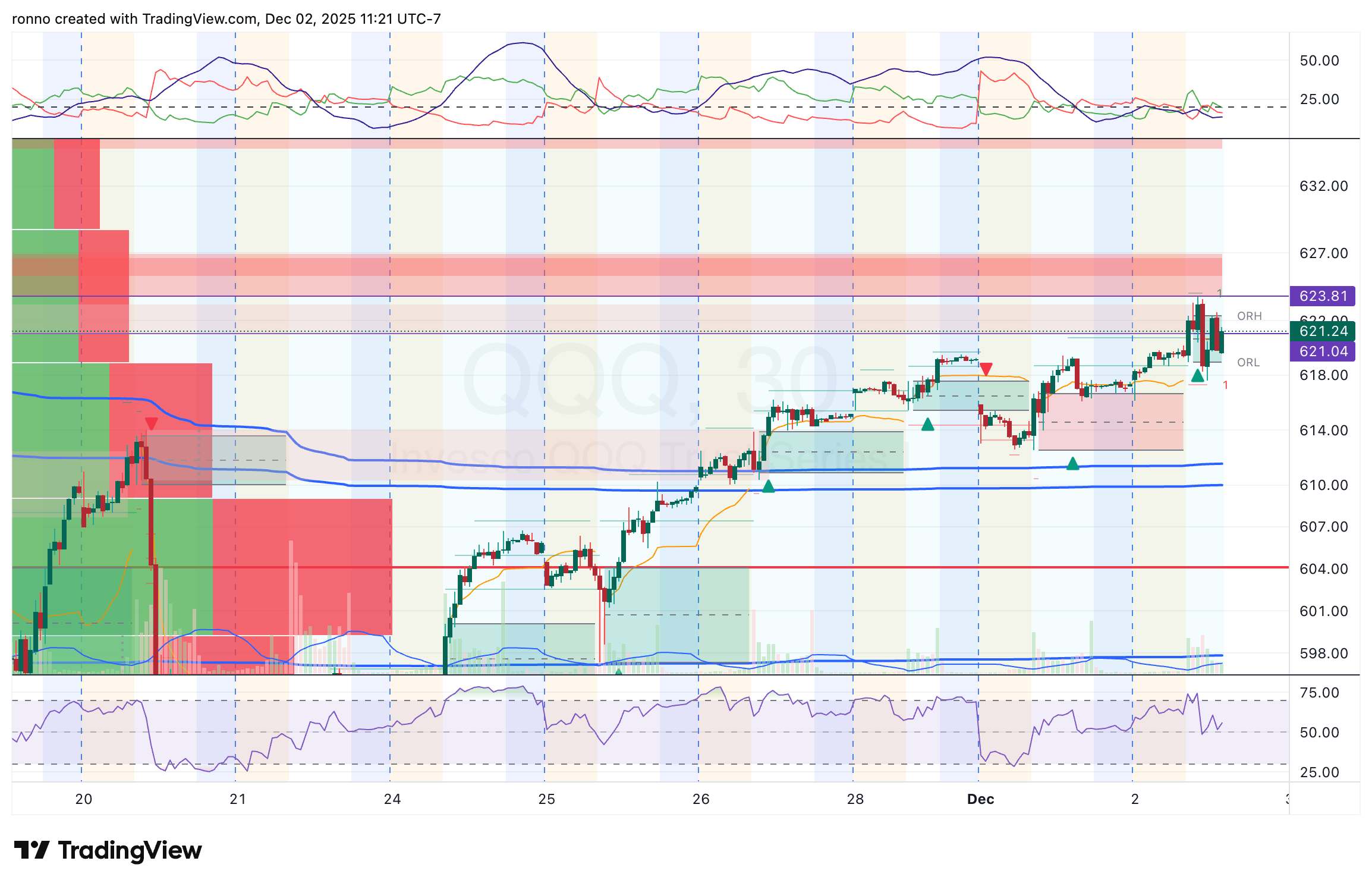

Short term (1 week): Bullish. QQQ broke above the late-October downtrend and reclaimed the 616/619 area; breadth improved sharply (71% above 20-day MA, >54% above 50-day MA), and small caps/semiconductors led. SPY/QQQ are within 1% of highs with bullish MACD crosses and supportive EMAs. VIX at 16.35 is subdued. Expect digestion after a four-day surge; resistance near 620 and support around 612/608 (EMA50). Catalysts include PCE (Fri) and FOMC; upside remains favored while above LinkLine/volume POC.

Longer term (1+ month): Bullish bias. Weekly momentum still soft (MACD negative), but seasonality and sector rotation are constructive. Industrials (XLI) recaptured prior lows, broadening the base beyond Tech. NVDA lags, but Semis/SMALL CAPS and AVGO momentum suggest Tech can stabilize and lead into mid-Dec/Jan. Trend likely consolidates post-Thanksgiving then challenges new highs, with best acceleration after FOMC. Risk if rotation mean-reverts from Energy/Healthcare into year-end.