QQQ & SPY: 2025 Snapshot

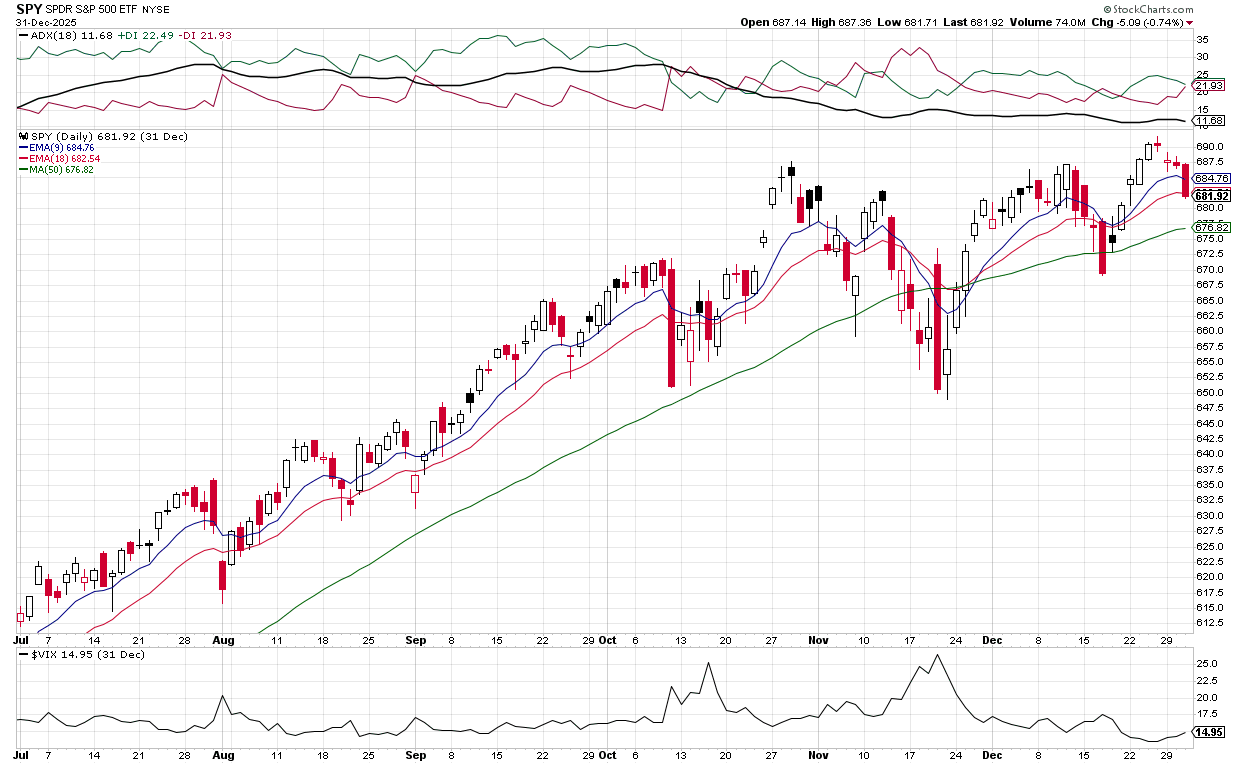

The final week of 2025 saw both QQQ and SPY retreat modestly. QQQ opened at 621.99 on Dec 25, rallied to a high of 624.28, but closed the period at 614.31—a decline of roughly 1.5%. SPY began at 687.95, peaked at 690.83, and finished at 681.86, down about 1.2%.

Technical indicators remained static across the week: EMA5, EMA9, EMA20 and EMA50 stayed at 618.37, 618.40, 617.63 and 614.79 for QQQ, and 685.79, 685.64, 683.95 and 679.65 for SPY. Both ETFs finished the week just above their short‑term EMAs (5‑, 9‑, 20‑day) but below the longer‑term EMA50, hinting at a test of intermediate support. The VIX sits at 14.33, reflecting a low‑volatility backdrop that can mask underlying fragility.

Macro fundamentals paint a mixed picture. Q3 GDP surprised with a 4.3% annualized rise, driven by consumer spending and government outlays, yet consumer confidence fell 3.8 points in December. Durable‑goods orders slipped 2.2% in October, and Fed minutes indicated expectations of further rate cuts in 2026. Initial jobless claims hit a near‑three‑year low of 199,000, reinforcing a resilient labor market. However, the market’s year‑end slump, broader sector rotation into energy, and the traditional “midterm‑year” underperformance pattern suggest heightened uncertainty ahead.

Outlook: With prices hovering near the EMA50, watch for either a bounce off that level or a break below it. Historically, midterm election years bring increased volatility and potential 10‑15% pullbacks. Maintaining disciplined risk management and using EMAs as dynamic support/resistance will be key as we enter 2026.