QQQ, SPY Dip, VIX Low

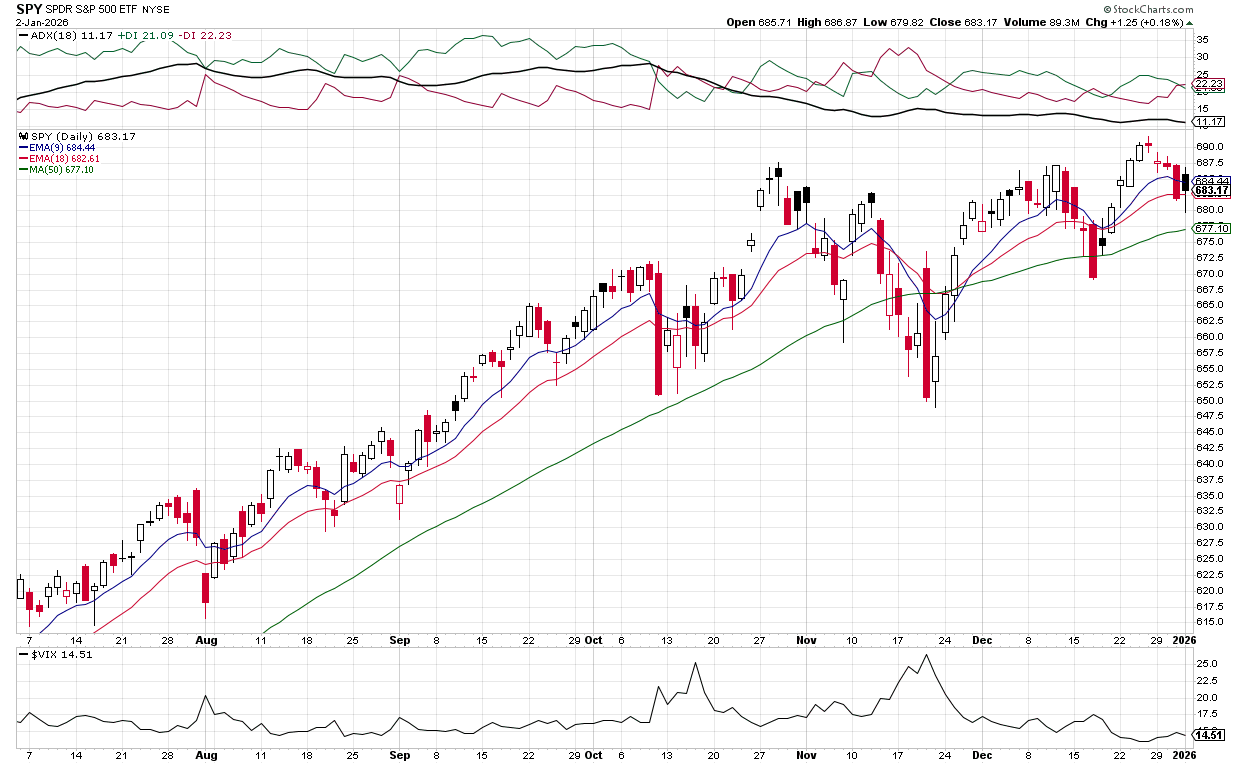

The Santa Claus rally fizzled, with QQQ and SPY posting three straight days of declines. Technical snapshot: QQQ closed 613.12 on Jan 2, slipping below its 20‑day EMA (617.15) after briefly trading above it; SPY closed 683.21, falling under its 20‑day EMA (683.87). Both ETFs now sit under the 20‑day EMA, signaling a short‑term bearish turn—EMA20 has shifted from support to resistance.

VIX sits at 14.33, indicating low volatility and complacency. Macro fundamentals appear supportive—Fed minutes hint at further rate cuts in 2026, and initial jobless claims fell to 199k, reinforcing a resilient labor market. Yet the market is entering a midterm election year, historically linked to heightened volatility and deeper pullbacks. Cycle analysis points to a “cooling‑off” phase after strong gains, with some strategists forecasting possible 10‑15% corrections.

For traders, watch the 20‑day EMA for a decisive bounce; a sustained move back above could restore the uptrend, while further weakness may invite deeper retracements. For long‑term investors, any dip could be a buying opportunity, especially given the historically strong post‑midterm rally. Overall, the break below EMA20 signals caution, while the low VIX suggests a brief pause before the next wave of volatility.