QQQ/SPY: Early Jan Tech

The first trading days of 2026 show QQQ drifting lower, closing $613.12 (‑1.73%) on Jan 2 after a narrow range. The ETF remains below its recent peak (~$625) and sits just under the 5‑day EMA at $620.80, indicating a modest bearish bias. EMAs: 5‑day 620.80, 9‑day 619.74, 20‑day 618.54, 50‑day 615.71. A decisive close above $625 would be needed to confirm a breakout.

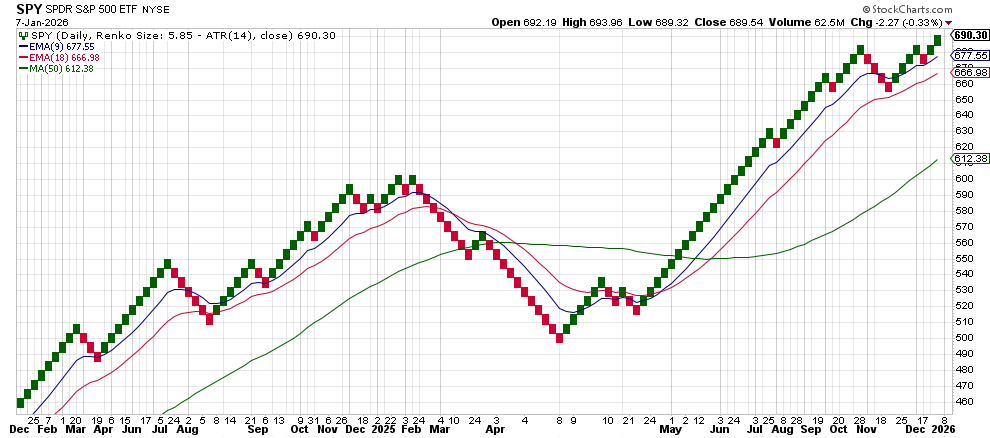

SPY, meanwhile, printed a light red “fake‑out” candle in December, closing the week at $683.17 (‑1.03%). Its EMAs are clustered (5‑day 688.37, 9‑day 687.39, 20‑day 685.53, 50‑day 681.20), showing price compression around the 50‑day level. A break above the December high (~$693) would target the next resistance near $700.

VIX remains subdued, hovering around 15, suggesting low volatility expectations. Macro fundamentals are mixed: pending home sales rose 3.3% in November, indicating a strengthening housing market; the Fed cut rates by 25 bps and signaled a pause amid moderating inflation and a softening labor market (initial claims fell to 199k). ISM services rebounded to 54.4, while job‑quits rose modestly.

Bottom line: Both QQQ and SPY are testing short‑term support, with a potential upside catalyst if QQQ breaches $625 and SPY pushes above its December high. Watch for a technical breakout to confirm the early‑year rally.