QQQ & SPY: EMA Snapshot

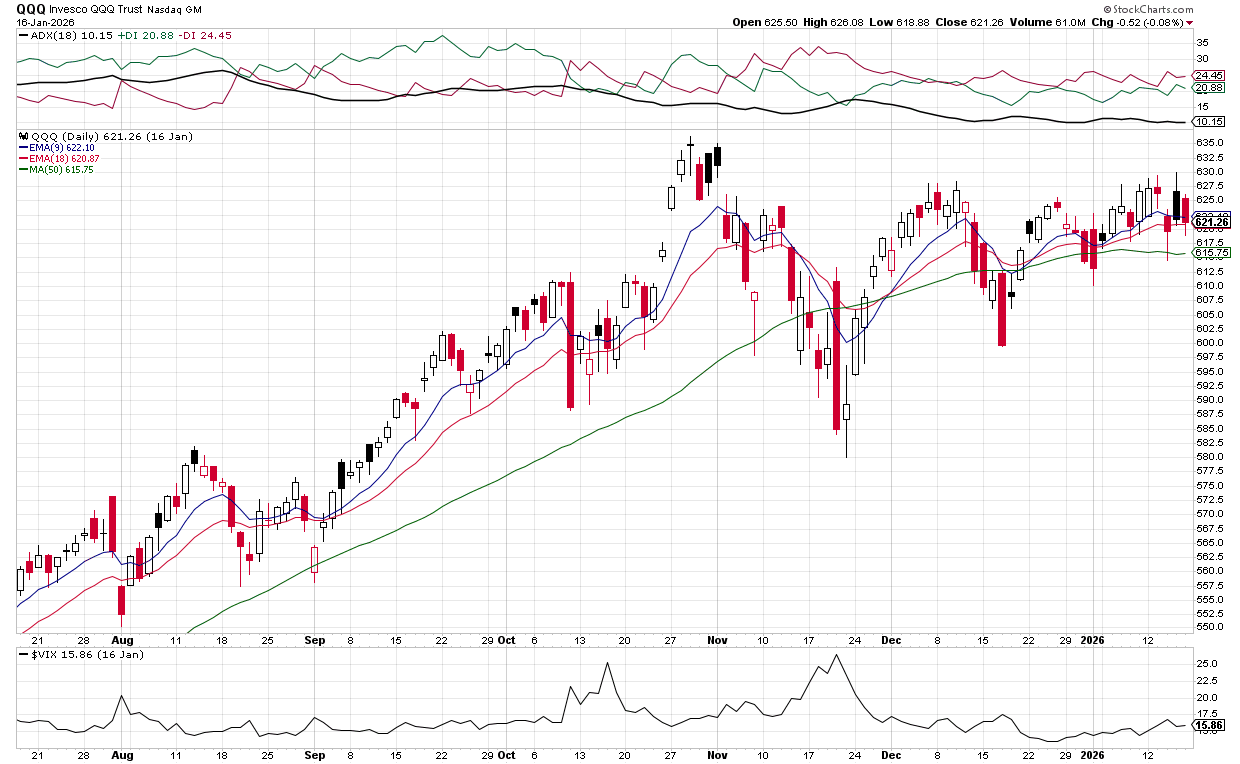

QQQ remains range‑bound around its flat EMAs (5 = 622.19, 9 = 622.11, 20 = 620.97, 50 = 617.92). From Jan 12 to Jan 16 the ETF traded from 622.31 to 627.17, slipped to 626.24, then fell to 619.55 before stabilizing near 621‑622—signaling indecision rather than a breakout.

SPY is modestly above its EMAs (5 = 691.89, 9 = 691.25, 20 = 689.22, 50 = 684.50) but the price has flattened at 690‑695, indicating a loss of momentum. The two indices are diverging: the S&P 500 (SPY) is posting higher highs while the Nasdaq‑100 (QQQ) fails to confirm, a classic warning that the market’s leaders are losing steam.

VIX ticked up from 15.98 to 16.75 before easing to 15.84—still low, but the modest rise hints at growing unease. The contributor notes historic spikes in silver (≈30% YTD) and ultra‑bullish sentiment (Ryex asset ratio) often precede deep corrections. A “negative gamma” backdrop suggests higher volatility and thinner liquidity ahead.

Overall, the data point to a cautious outlook: a 10‑20% pullback is plausible. Traders should tighten stops, take partial profits, and favor fading strength over chasing new highs.

TICKER: QQQ