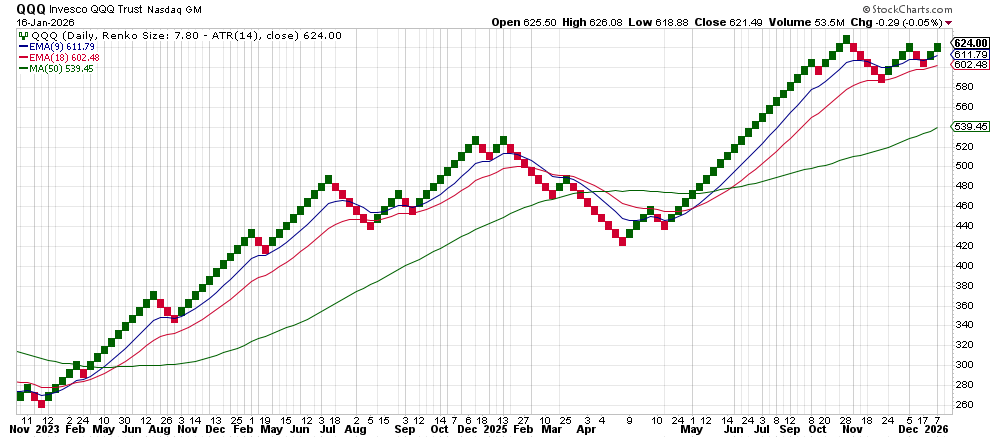

QQQ & SPY Jan 2026

QQQ is trading above its long‑term EMAs (EMA20 ≈ 620.99, EMA50 ≈ 617.93) but has slipped back toward the tight cluster of EMA5 ≈ 622.24 and EMA9 ≈ 622.14, suggesting a short‑term consolidation after a recent high near 630. The close on Jan 14 at 619.55 fell below EMA5, hinting at a modest pullback.

SPY remains near its EMA5 ≈ 692.03 and EMA9 ≈ 691.33, yet the Jan 14 close of 690.36 is just under those averages, indicating mild weakness. Both ETFs retain strong support from EMA20 ≈ 689.27 and EMA50 ≈ 684.53, which should hold unless broader sentiment deteriorates.

VIX rose from 15.12 on Jan 12 to 16.75 on Jan 14, signaling heightened volatility. This aligns with the observed divergence highlighted in the journal: the S&P 500 (SPY) continues to make higher highs while the Nasdaq‑100 (QQQ) fails to confirm, a classic sign of a weakening rally.

Overall, bulls are still in control thanks to improving growth and earnings, but the VIX uptick and sector rotation into defensive groups argue for a cautious stance. Traders should watch QQQ for support around the EMA20/EMA50 region and be prepared for a potential 5‑10 % pullback before any renewed upside. Tight stops and reduced position sizes are advisable given the elevated volatility.

TICKER: QQQ