QQQ, SPY, VIX Tech

QQQ remains below key resistance levels at 627 and 637, despite holding near its EMA5 (~620.9) and EMA9 (~619.1). The price has hovered around these short‑term moving averages for three sessions, suggesting a consolidation phase. EMA20 (~617.5) is now below price, reinforcing a near‑term bullish bias, while EMA50 (~614.3) still lags, indicating a longer‑term uptrend is emerging.

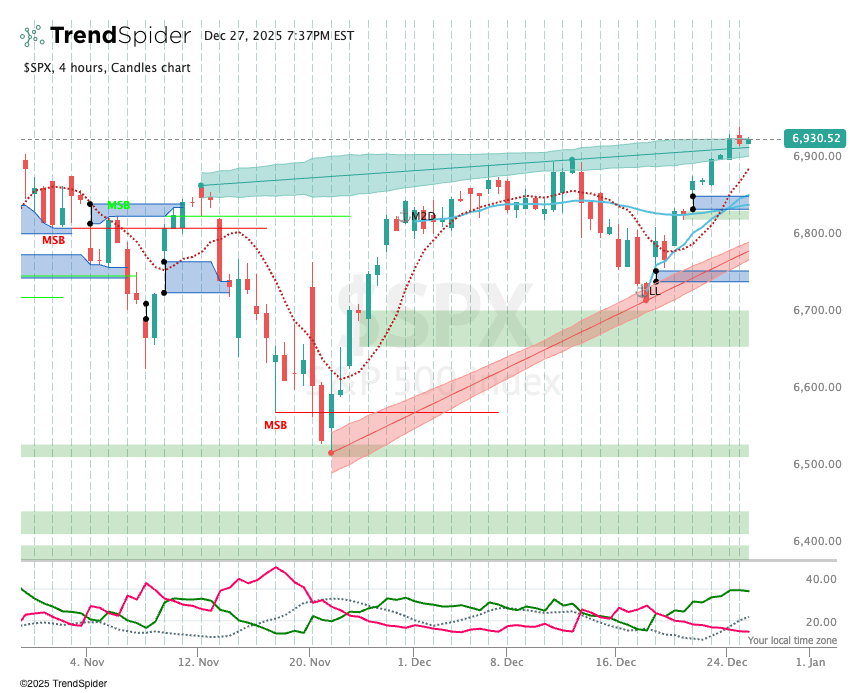

SPY, in contrast, shows clearer strength. Its close on Dec 26 (690.24) sits comfortably above EMA5 (~687.1) and EMA9 (~685.0), and well above EMA20 (~682.6) and EMA50 (~678.1). The index is testing the upper bound of a resistance triangle formed in late October, with a potential breakout above 690.3 signaling continuation.

VIX at 14.00 signals low volatility, supporting risk‑on sentiment. Economic data add nuance: strong GDP (4.3% annualized) and falling jobless claims (214k) bolster bullish fundamentals, yet consumer confidence has slipped to near five‑year lows, creating a divergence between hard data and sentiment. This tension may keep the market in a narrow range until either sentiment improves or a catalyst pushes indices through resistance.

Overall, SPY appears technically leading, while QQQ waits for a breakout above 627. Traders should watch QQQ for a decisive move toward 637 and SPY for confirmation above the triangle apex, as low VIX implies limited downside risk.