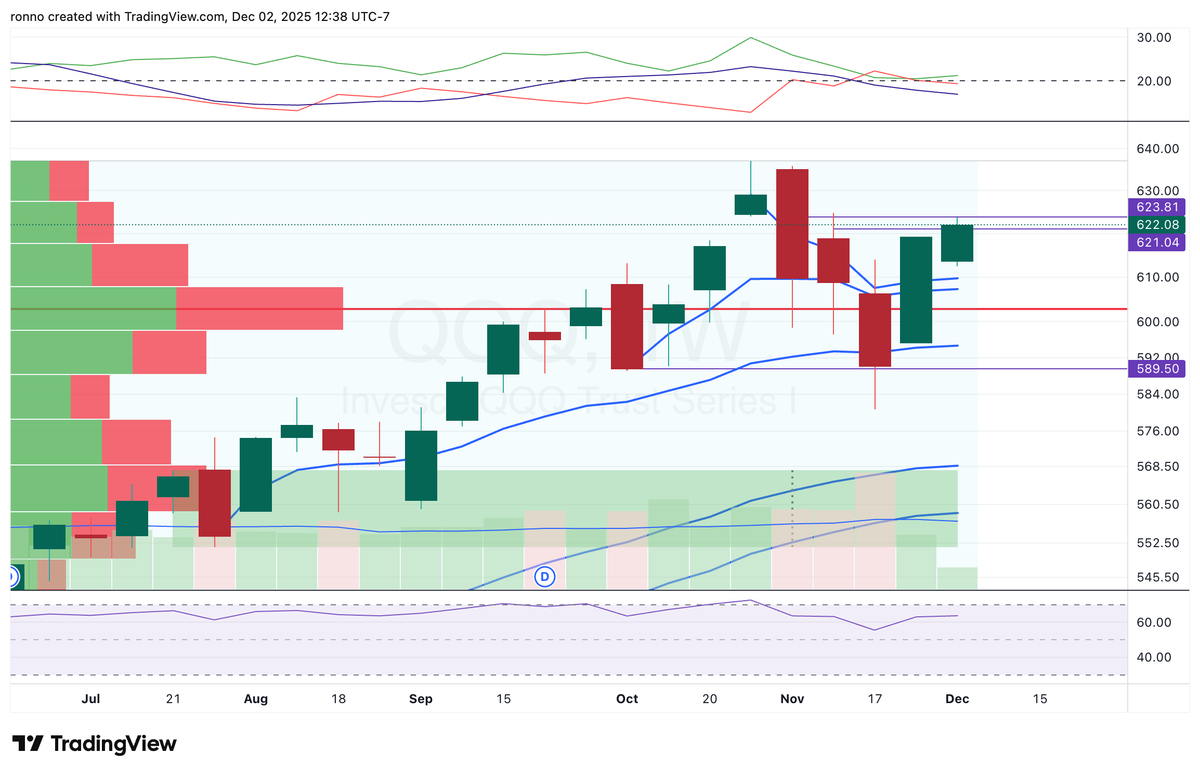

ST: Bearish, LT: Slightly Bullish

Short-term (1 week): Bearish

QQQ broke Tuesday’s lows and closed at 585.67, well below EMA20 and EMA50 (608.9, 606.6), with EMAs turning down—signaling momentum breakdown. VIX near 24.7 is elevated, implying volatility risk. Labor data is mixed: initial claims low (220k) but continuing claims at a cycle high, and unemployment up to 4.4%, suggesting cooling. Energy outlook is softer (EIA/OPEC lower oil prices, inventories rising), adding drag. Positioning for weakness into Thanksgiving.

Long-term (1+ month): Slightly Bullish

NFIB optimism remains above its 52‑year average; price pressures easing should help margins. NVDA’s strength and robust AI/data‑center demand are tailwinds for QQQ (electricity demand forecast up 2.4–2.6%). Offsetting: oil inventory builds and non‑OPEC supply growth suggest caution, but the broad market breadth and energy consumption secular trend favor a grind higher over the month if tech stabilizes.