ST: Bullish, LT: Bullish with Caution

**Short‑Term (1 week)** – Bullish.

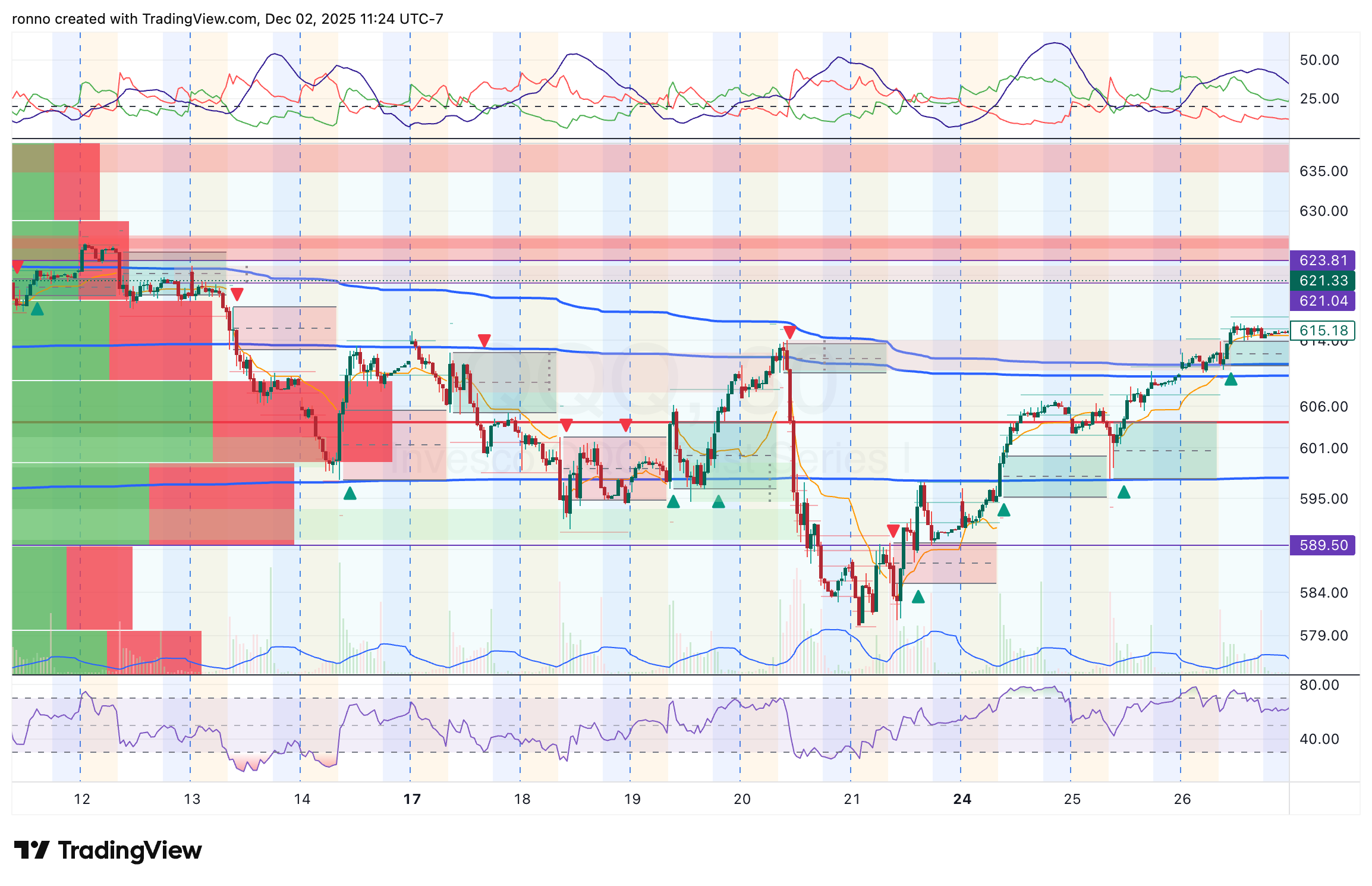

- QQQ broke the late‑October downtrend and cleared the 616 resistance, closing at $619.25.

- Breadth turned positive: ≈71 % of stocks are above their 20‑day MA and >54 % above the 50‑day MA, a four‑day “thrust” not seen since late‑August.

- SPY reclaimed its year‑to‑date volume point of control and is 1 % from its all‑time high.

- VIX slipped to 18.56, signaling calm risk appetite.

- Sector rotation is healthy: Industrials recaptured prior lows; small‑caps led the rally; semiconductors showed momentum despite NVDA lag.

- Expect modest consolidation after the holiday, but upside bias remains.

**Long‑Term (1 + month)** – Bullish with caution.

- Weekly MACD on SPX is still negatively sloped, indicating residual weakness, yet a decisive breakout above prior highs is underway.

- Tech, the worst sector of the past month, shows early signs of stabilization (e.g., AVGO, MSFT, AMD) while other groups (Industrials, Financials, Consumer Discretionary) are picking up slack.

- Rising odds of a December rate cut and upcoming PCE data support a risk‑on backdrop.

- The emerging breadth thrust and low volatility set the stage for a move toward new highs after a brief consolidation, with potential acceleration post‑FOMC.

- Monitor NVDA’s recovery; further strength there would cement the broader rally.