Week of Dec 22‑26

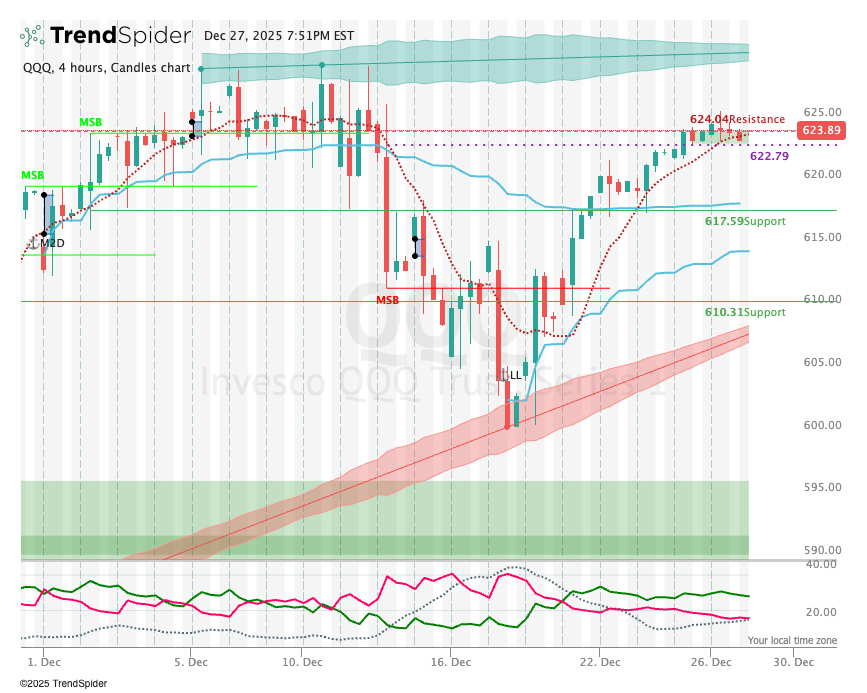

The market closed out the holiday week with mixed signals. QQQ remained under pressure, moving from a 619.17 close on Dec 22 to a 623.87 finish on Dec 26—still well below the first resistance cluster around 627 and the secondary ceiling near 637. The low of the week at 617.78 reinforced a short‑term support zone near 618, keeping the index trapped in a narrow range.

SPY showed a steadier climb, rising from 684.72 to 690.24. The index now sits just shy of a key resistance band at 691, while its nearest support sits around 688. In parallel, the broader S&P 500 is testing the 6,903 level, a historic line in the sand that could dictate short‑term direction. Negative breadth (more declining than advancing stocks) tempered the bullish tone, though sector leaders such as FCX, JBL, GILD, AZO, and C provided some counter‑balance.

VIX slipped to 14.00, reflecting low implied volatility and a generally complacent mood. This backdrop, coupled with solid macro data—GDP up 4.3% annualized, initial jobless claims down to 214 k—offers a supportive macro environment. Yet consumer confidence hit a five‑year low (89.1), highlighting a divergence between hard spending data and sentiment.

Outlook: QQQ needs a decisive move above 627 to unlock a breakout toward 637; otherwise, it may continue to consolidate near 618‑623. SPY’s proximity to 691 suggests a near‑term test of the 692‑695 range if breadth improves. With VIX hovering near its floor, any upside in volatility could quickly tighten risk‑on positioning. Watch the 6,903 SPX level and sector rotation for clues on the next leg.